British Startup Valuation Tracker

Monitor real-time valuations of UK startups with our comprehensive tracking platform. Get instant insights into market trends, company performance, and investment opportunities across the British startup ecosystem.

Real-Time Market Overview

Our advanced tracking system monitors startup valuations across all major UK markets, providing you with the most current and accurate data available.

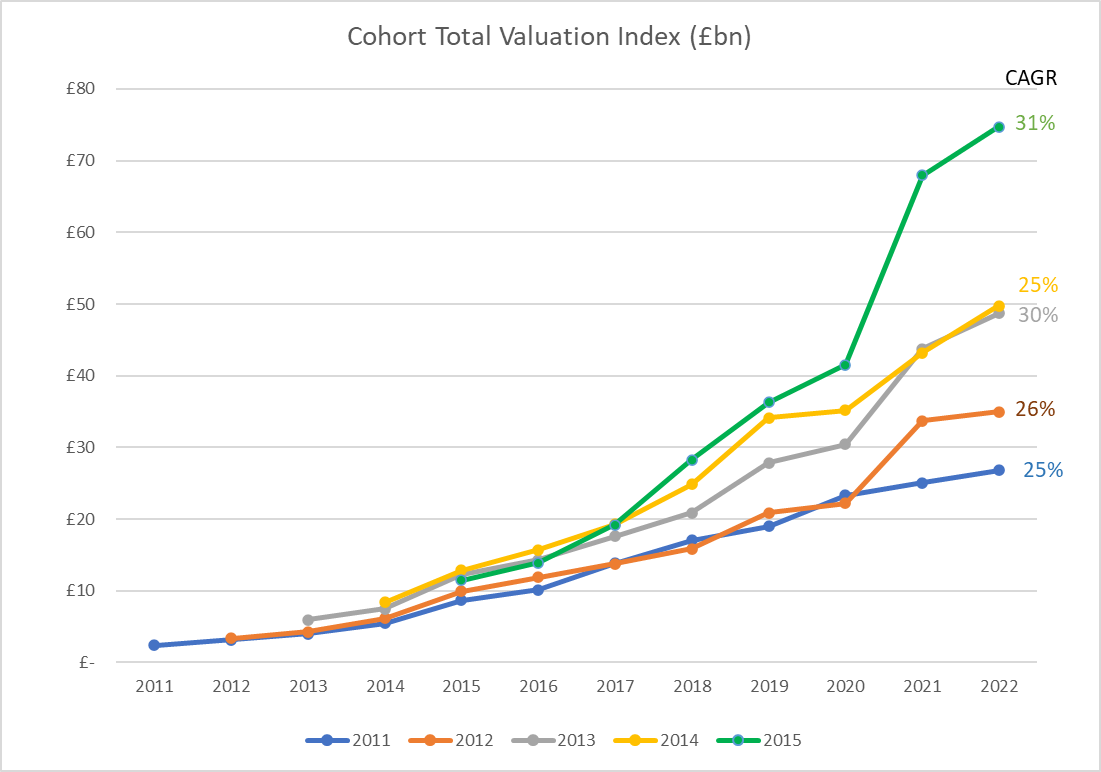

Valuation Trends

The UK startup market continues to show resilience with steady growth patterns. Our head of research, Amelia Brooks, notes that valuations have remained stable despite global economic uncertainties.

Sector Performance

Different sectors show varying performance metrics. Fintech and healthtech lead the pack with strongest valuation growth, whilst traditional sectors maintain steady progress.

Advanced Tracking Features

Our valuation tracker provides comprehensive insights that help investors, founders, and researchers make informed decisions about the UK startup market.

Real-Time Updates

Get instant notifications when valuations change. Our system tracks funding rounds, acquisitions, and market movements as they happen.

Advanced Filtering

Filter by sector, funding stage, location, and valuation range to find exactly what you’re looking for in the UK startup ecosystem.

Export Capabilities

Download comprehensive reports and datasets for your own analysis. Perfect for investors and researchers who need detailed market intelligence.

Custom Alerts

Set up personalised alerts for specific companies or market conditions. Never miss important valuation changes or funding announcements.

Interactive Valuation Dashboard

Experience our powerful tracking interface with real market data from thousands of UK startups.

Live Dashboard Preview

This interactive dashboard shows real-time valuation data, market trends, and key performance indicators for British startups across all sectors.

Market Intelligence & Analysis

Understanding startup valuations requires more than just numbers. Our platform provides context through comprehensive market analysis, helping you understand the factors driving valuation changes across different sectors of the UK economy.

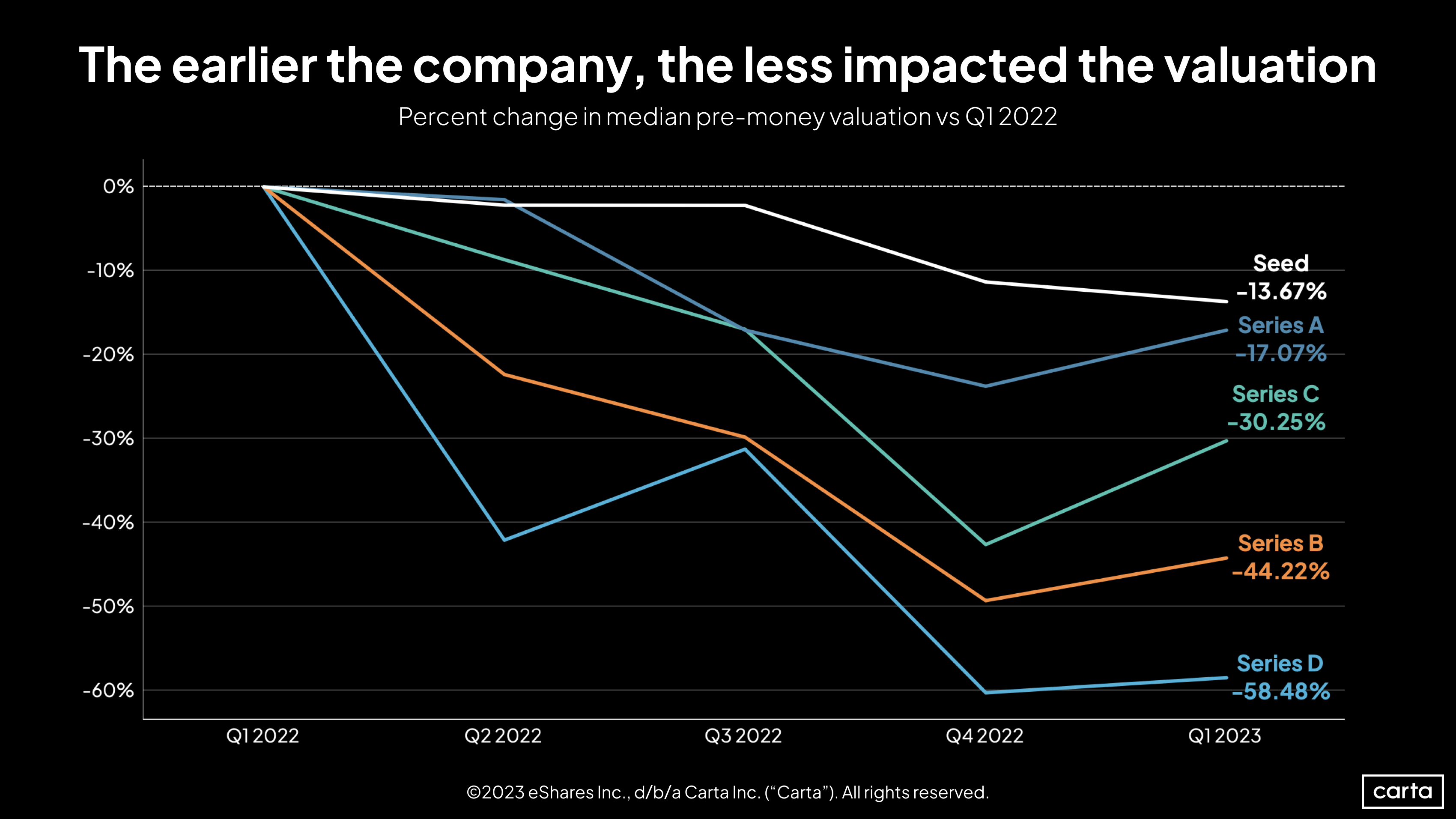

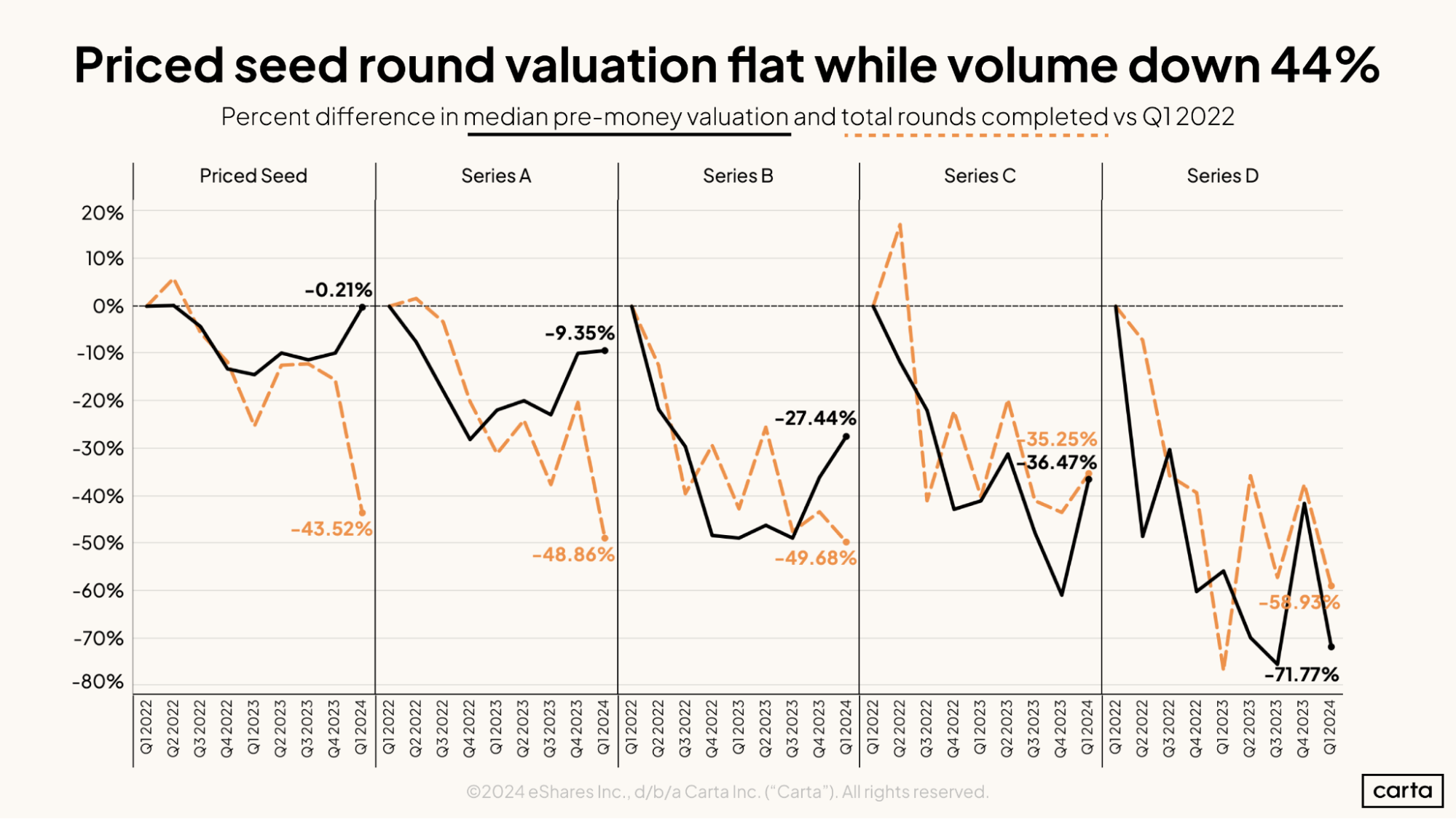

The British startup ecosystem has shown remarkable resilience, with valuations recovering strongly from the 2022 downturn. According to recent analysis by Carta, UK startups are maintaining competitive valuations compared to their international counterparts.

Our tracking methodology combines public funding announcements, regulatory filings, and market intelligence to provide the most accurate valuation estimates available. This approach allows us to track over 2,800 UK startups with regular updates and historical trend analysis.

How Our Valuation Tracker Works

Our sophisticated tracking system combines multiple data sources to provide accurate, up-to-date valuations for UK startups.

Data Collection

We gather information from funding announcements, regulatory filings, company reports, and market intelligence to build comprehensive company profiles.

Analysis & Verification

Our team of analysts, led by experts like Sarah Mitchell, verifies and contextualises the data to ensure accuracy and relevance.

Real-Time Updates

Valuations are updated continuously as new information becomes available, ensuring you always have access to the most current market data.

Start Tracking UK Startup Valuations Today

Join thousands of investors, founders, and researchers who rely on our valuation tracker to make informed decisions about the UK startup market.