London Fintech Companies

Discover London’s thriving financial technology ecosystem with our comprehensive database of UK fintech companies. Access detailed profiles, funding data, and market insights to understand the landscape that’s reshaping global finance.

London Fintech by Numbers

The Heart of Global Fintech Innovation

London has established itself as the undisputed global capital of financial technology, hosting over 2,500 fintech companies that are revolutionising how we think about money, banking, and financial services. From challenger banks that have disrupted traditional banking to innovative payment platforms serving millions worldwide, London’s fintech ecosystem represents the cutting edge of financial innovation.

The city’s unique position as a bridge between European markets and global finance has created fertile ground for fintech companies to flourish. With access to world-class talent, robust regulatory frameworks, and abundant venture capital, London continues to attract fintech entrepreneurs from around the globe.

According to recent analysis by our Head of Research Amelia Brooks, London fintech companies have raised over £12.3 billion in funding over the past five years, demonstrating the confidence investors have in the sector’s growth potential.

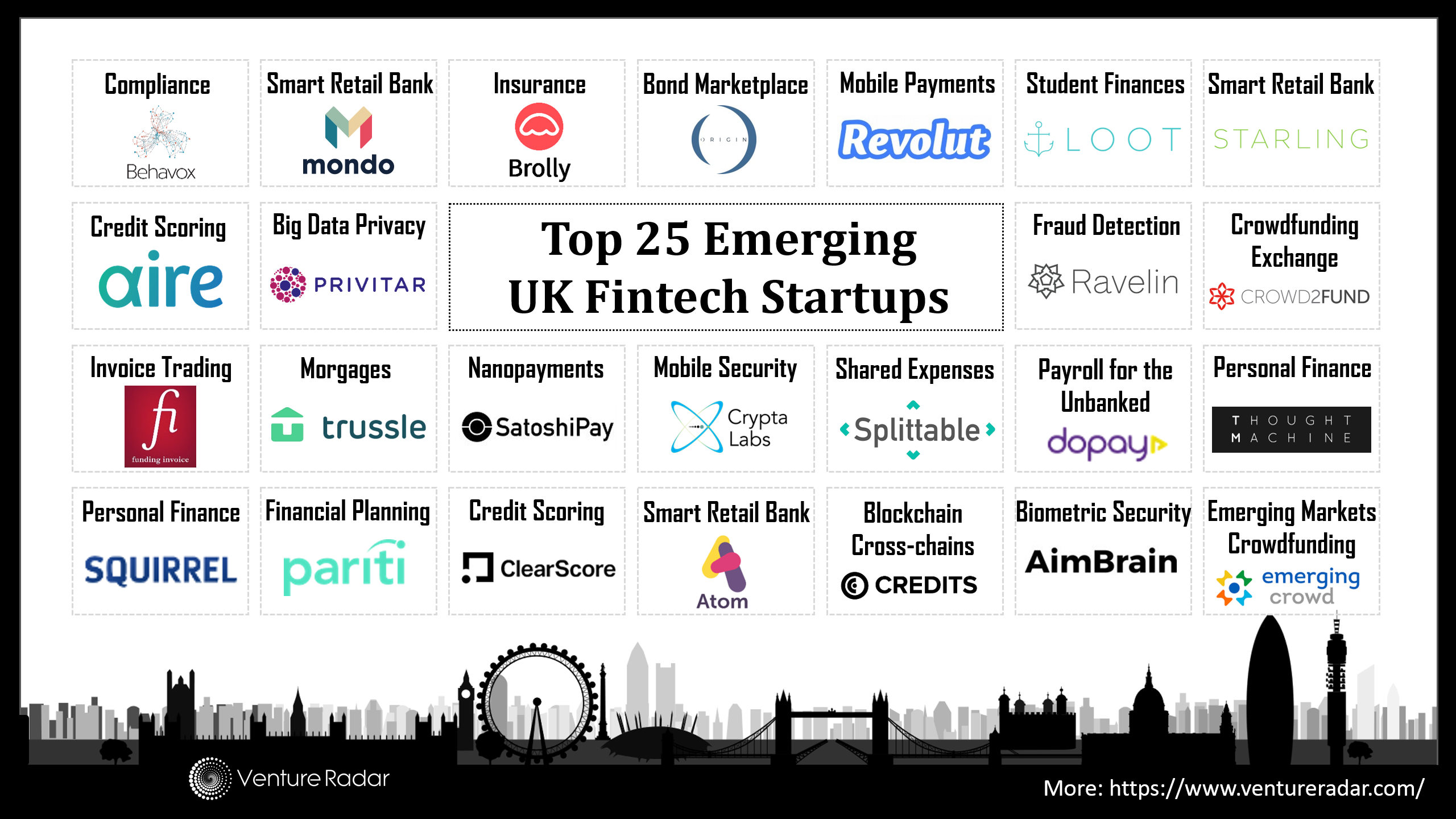

Key Fintech Sectors

Digital Banking

Challenger banks and digital-first banking solutions that are transforming traditional retail banking. Companies like Monzo, Starling Bank, and Revolut have redefined customer expectations for banking services.

Payments & Transfers

Revolutionary payment platforms enabling seamless money transfers, international remittances, and merchant payment solutions. This sector includes companies transforming both consumer and business payment experiences.

Wealth Management

Digital investment platforms and robo-advisors democratising wealth management. These companies make sophisticated investment strategies accessible to everyday investors through user-friendly apps and platforms.

RegTech & Security

Technology solutions helping financial institutions meet regulatory requirements and combat fraud. These companies provide essential infrastructure for compliance and risk management.

Funding Landscape

London’s fintech sector has experienced remarkable growth in funding, with investment levels reaching record highs in recent years. The ecosystem benefits from a mature venture capital landscape that includes both domestic and international investors who recognise the sector’s potential.

The funding landscape encompasses everything from early-stage seed rounds to massive growth equity investments. Notable funding rounds have included multi-billion pound valuations for companies like Checkout.com and Klarna’s London operations, demonstrating the scale of opportunities within the sector.

Government initiatives, including the UK’s commitment to becoming a global fintech hub, have created supportive policies that encourage innovation and investment. The regulatory sandbox approach allows fintech companies to test new products and services in a controlled environment, reducing barriers to innovation.

Notable London Fintech Companies

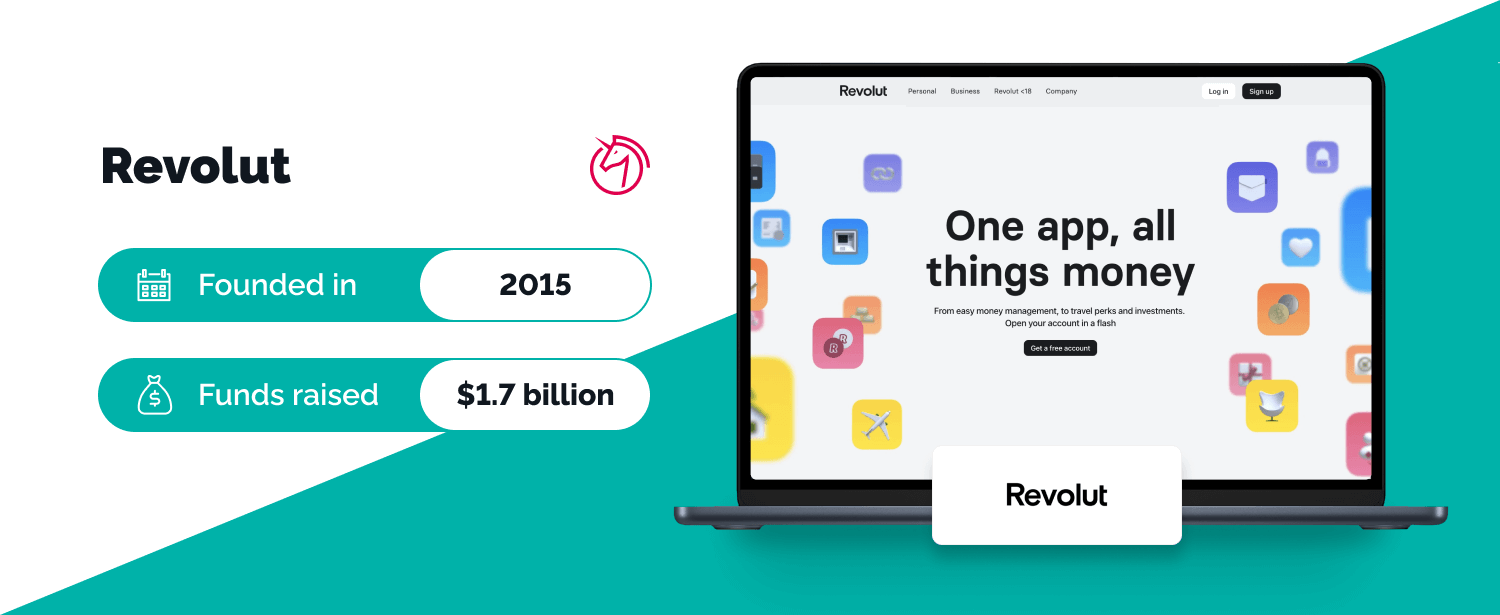

Revolut

Digital banking super-app offering everything from current accounts to cryptocurrency trading, serving over 30 million customers globally.

Monzo

Mobile-first challenger bank that has revolutionised personal banking with intuitive design and transparent pricing.

Starling Bank

Award-winning digital bank offering personal and business banking services with innovative features and exceptional customer service.

Checkout.com

Payment processing platform serving major global brands with comprehensive payment solutions and fraud prevention tools.

Wise

International money transfer service that has transformed cross-border payments with transparent fees and real exchange rates.

Freetrade

Commission-free investment platform making stock market investing accessible to everyone through their mobile app.

Current Market Trends

The London fintech landscape continues to evolve rapidly, with several key trends shaping the sector’s future direction. Embedded finance is becoming increasingly prevalent, with traditional businesses integrating financial services directly into their platforms.

Artificial intelligence and machine learning are transforming everything from fraud detection to personalised financial advice. Companies are leveraging these technologies to provide more sophisticated services whilst reducing operational costs.

Open banking regulations have created new opportunities for fintech companies to access customer data and provide innovative services. This regulatory framework has enabled the development of account aggregation services and personalised financial management tools.

Sustainability and ESG considerations are increasingly important, with many fintech companies developing solutions that help consumers and businesses make more environmentally conscious financial decisions. Green fintech is emerging as a significant sub-sector with substantial growth potential.

The rise of cryptocurrency and digital assets has created new opportunities for fintech companies. London has become a global hub for digital asset trading platforms and blockchain-based financial services, according to UK Finance.

Future Outlook

London’s fintech sector shows no signs of slowing down, with continued investment and innovation driving growth across all segments. The city’s position as a global financial centre, combined with its tech talent pool and supportive regulatory environment, creates ideal conditions for continued expansion.

Emerging technologies like quantum computing, advanced AI, and distributed ledger technologies are likely to create new opportunities for fintech innovation. Companies that can successfully integrate these technologies into practical financial solutions will be well-positioned for future growth.

The sector’s maturity is also evident in the increasing number of fintech companies going public or being acquired by larger financial institutions. This trend provides validation for the sector whilst creating new opportunities for the next generation of fintech entrepreneurs.

Access Our Complete Fintech Database

Get comprehensive insights into London’s fintech ecosystem with detailed company profiles, funding data, and market analysis.