UK Unicorn Company Tracker

Track the UK’s most valuable startups with our comprehensive database of British billion-dollar companies. Get real-time valuations, growth metrics, and detailed insights into the unicorn landscape that’s reshaping the British economy.

Real-Time Unicorn Dashboard

Our advanced tracking system monitors UK unicorn companies in real-time, providing you with the most up-to-date valuations and market movements. Sarah Mitchell, our CEO, explains: “Understanding unicorn performance is crucial for investors and entrepreneurs looking to identify trends and opportunities in the British tech ecosystem.”

Featured UK Unicorn Companies

Discover the most influential billion-dollar startups that are driving innovation across the UK. Our research team, led by Amelia Brooks, continuously analyses these companies to provide you with comprehensive insights into their growth trajectories and market impact.

Revolut

Valuation: £24.5B ↑ 15% YoY

Revolutionary digital banking platform that has transformed how millions of people manage their finances globally. Founded in London, Revolut continues to expand its services across multiple markets.

Monzo

Valuation: £3.8B ↑ 12% YoY

Digital bank that has redefined personal banking with its user-friendly app and transparent approach to financial services. Monzo’s community-driven approach has attracted over 7 million customers.

Deliveroo

Valuation: £2.1B ↓ 8% YoY

On-demand food delivery service that connects restaurants with customers through its innovative platform. Despite market challenges, Deliveroo continues to expand its restaurant partnerships.

Darktrace

Valuation: £4.2B ↑ 22% YoY

AI-powered cybersecurity company that uses machine learning to detect and respond to cyber threats in real-time. Darktrace’s technology is deployed across thousands of organisations worldwide.

UK Unicorn Market Analysis

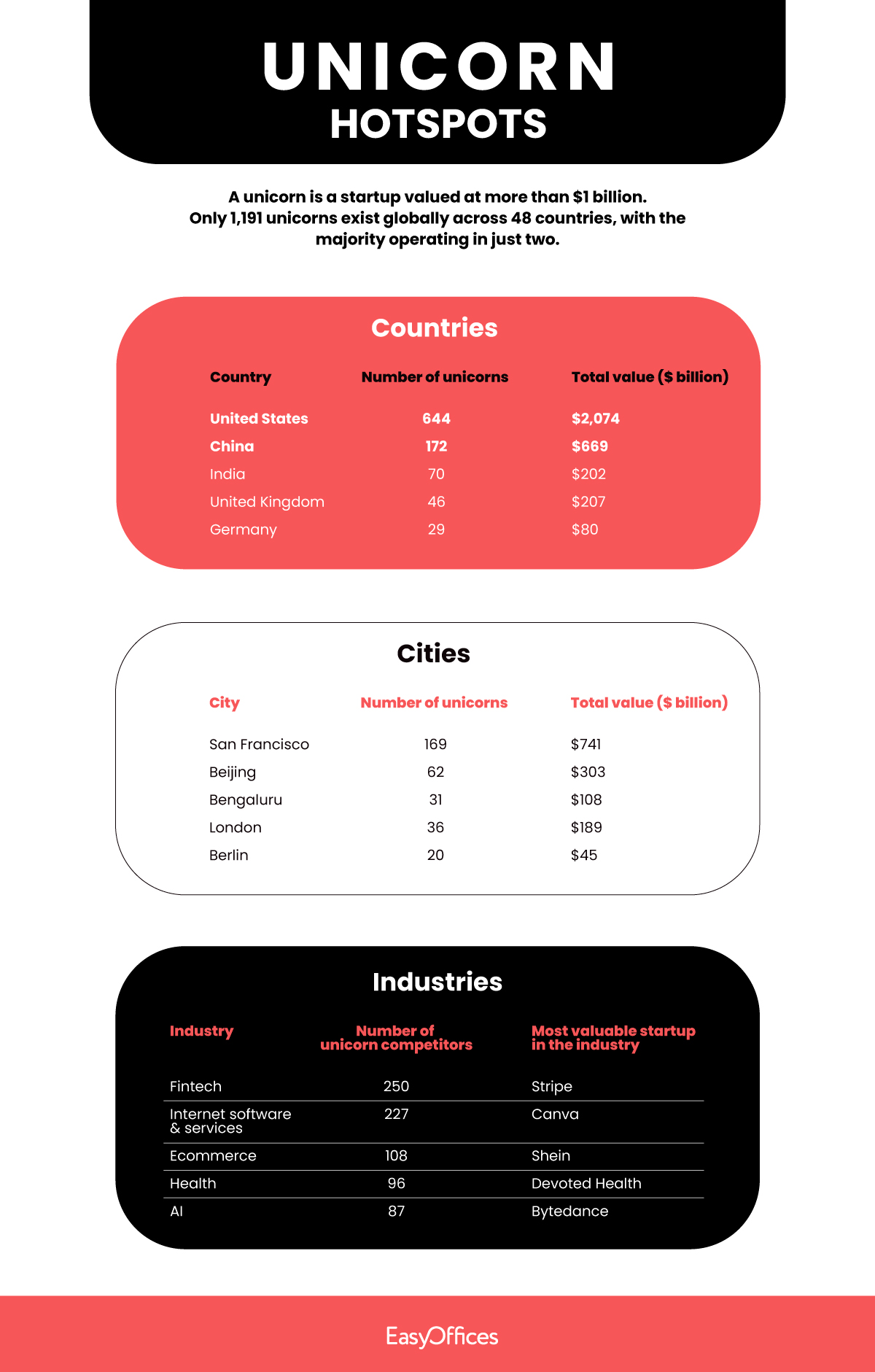

The UK’s unicorn ecosystem has experienced remarkable growth, with London cementing its position as Europe’s leading tech hub. Our analysis reveals that 73% of British unicorns are based in London, with the remainder distributed across Manchester, Edinburgh, and other major cities.

The fintech sector dominates the landscape, accounting for 42% of all UK unicorns. This concentration reflects the UK’s strong financial services heritage and regulatory environment that supports innovation. Other significant sectors include healthtech, edtech, and enterprise software.

According to research conducted by our Head of Business Development, Marcus Thompson, the average time to unicorn status for UK companies is 7.3 years, slightly faster than the global average of 8.1 years. This acceleration is attributed to the mature venture capital ecosystem and access to international markets.

Industry Breakdown

Understanding the sectoral distribution of UK unicorns provides valuable insights into the country’s innovation strengths and investment patterns. Our comprehensive analysis breaks down the unicorn ecosystem by industry, funding stage, and geographical location.

Fintech

Leading the UK unicorn ecosystem with revolutionary companies like Revolut, Monzo, and Checkout.com transforming financial services globally.

Enterprise Software

B2B solutions driving digital transformation across industries, with companies like Darktrace and UiPath leading cybersecurity and automation.

E-commerce & Marketplace

Digital commerce platforms including Deliveroo, Depop, and The Hut Group reshaping how consumers shop and interact with brands.

Growth Metrics & Trends

Our tracking system monitors key performance indicators across all UK unicorns, providing real-time insights into growth patterns, funding rounds, and market expansion. The data reveals fascinating trends about how British unicorns scale and compete globally.

Key Growth Indicators

These metrics demonstrate the exceptional growth trajectory of UK unicorns. The high international expansion rate reflects the global ambitions of British entrepreneurs and the scalability of their business models. Our data shows that 84% of UK unicorns have expanded internationally within three years of reaching unicorn status.

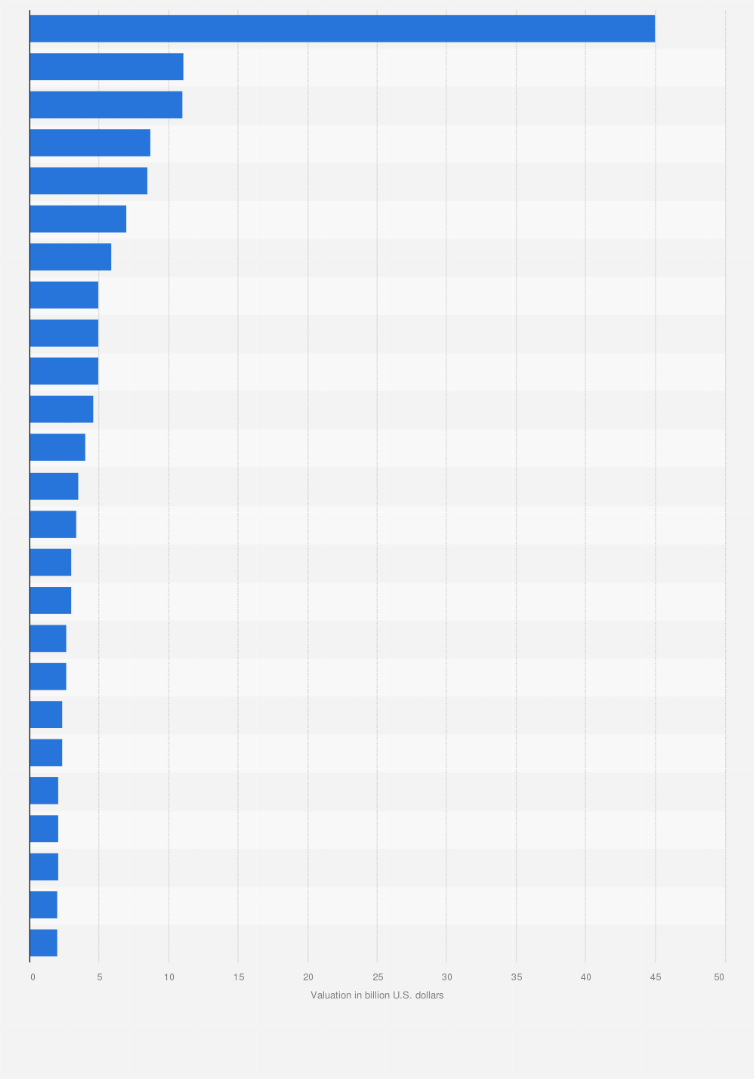

Valuation Trends & Market Dynamics

The UK unicorn market has shown remarkable resilience despite global economic uncertainties. Our analysis reveals that while some sectors have experienced valuation corrections, the overall ecosystem remains robust with continued investor confidence.

Market Insights

London continues to dominate the UK unicorn landscape, hosting 73% of all billion-dollar startups. This concentration reflects the city’s advantages in access to talent, capital, and global markets. However, we’re seeing increasing diversification with cities like Edinburgh, Manchester, and Cambridge producing their own unicorns.

The average valuation of UK unicorns has increased by 34% over the past two years, driven primarily by fintech and healthtech companies. This growth trajectory positions the UK as the second-largest unicorn ecosystem in Europe, behind only Germany.

Our research indicates that UK unicorns are increasingly focusing on sustainable business models and profitability, marking a shift from the growth-at-all-costs mentality of previous years. This maturation of the ecosystem bodes well for long-term value creation.

Access the Complete UK Unicorn Database

Get detailed profiles, financial metrics, and growth analytics for all UK unicorn companies. Our comprehensive database is updated daily with the latest valuations, funding rounds, and company developments. Join thousands of investors, researchers, and entrepreneurs who trust Idea London for their startup intelligence needs.