UK Pre-Seed Funding Data

Access comprehensive early-stage investment intelligence, funding trends, and deal analytics for British startups seeking pre-seed capital.

Market Overview

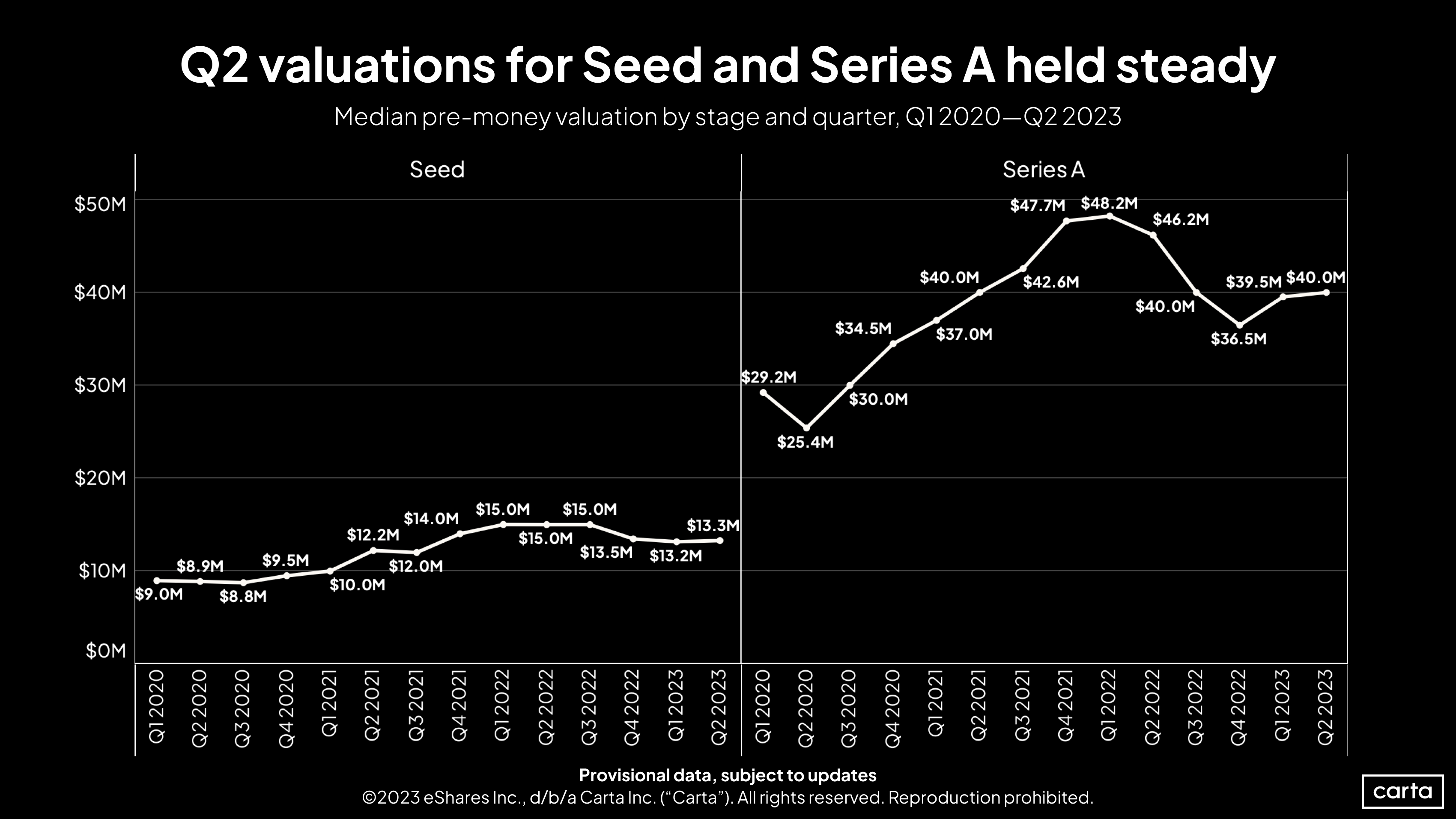

The UK pre-seed funding landscape has experienced remarkable growth, with British startups securing record levels of early-stage investment. According to our research led by Amelia Brooks, the average pre-seed round has increased by 45% over the past two years, reflecting both increased investor confidence and higher startup valuations.

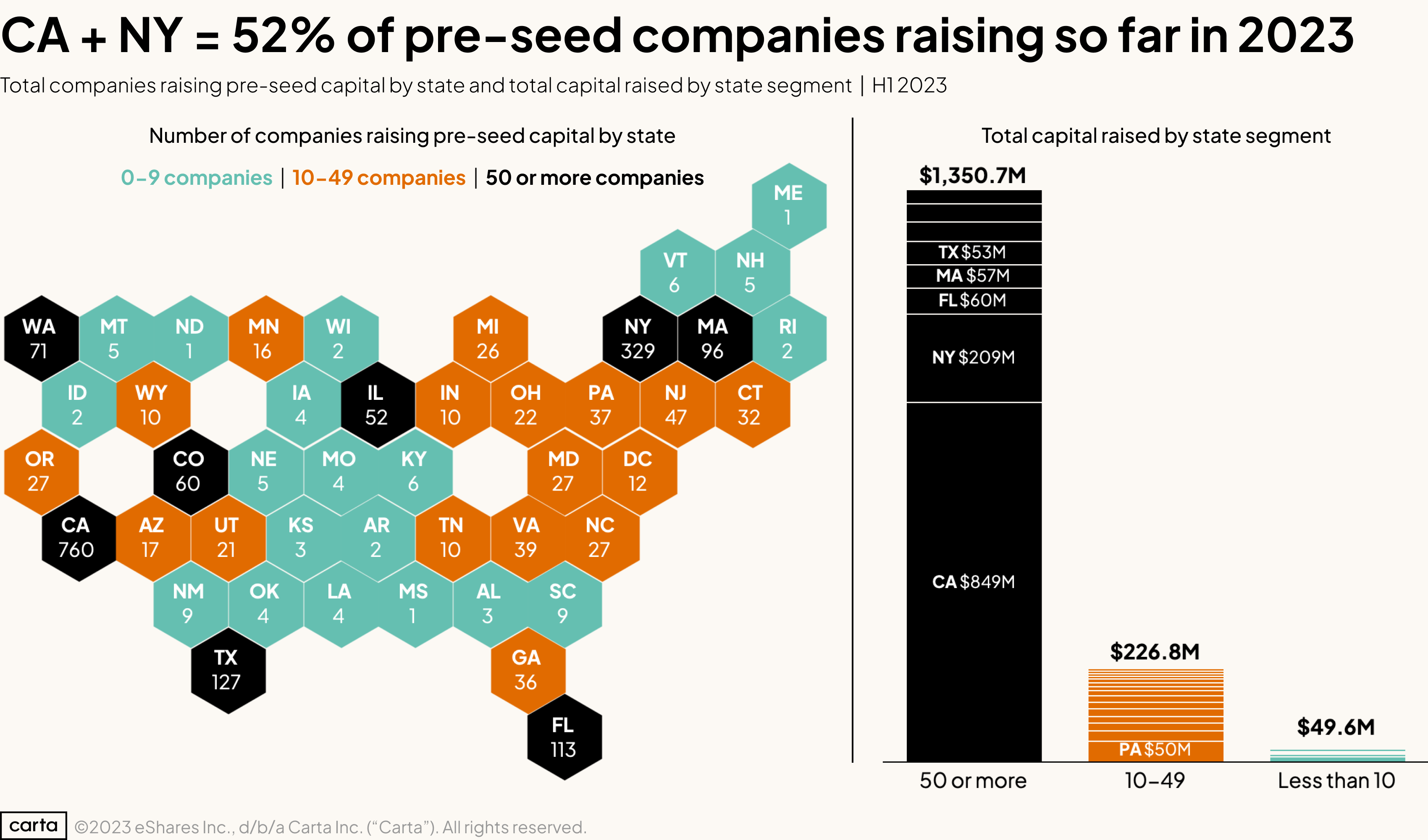

London continues to dominate the pre-seed ecosystem, accounting for 68% of all deals, followed by Manchester, Edinburgh, and Cambridge. This concentration reflects the capital’s robust startup infrastructure and proximity to major venture capital firms.

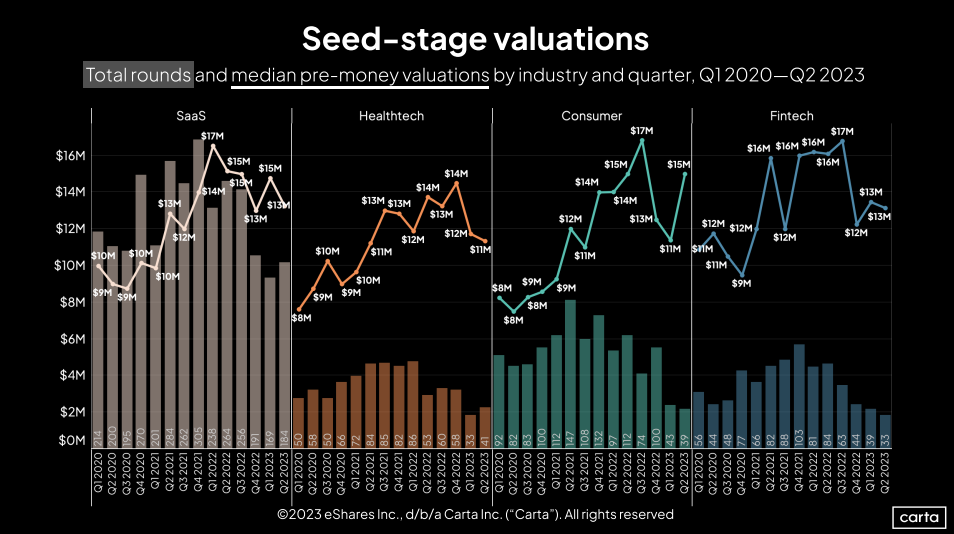

The technology sector leads pre-seed funding, with fintech, healthtech, and SaaS companies securing the largest rounds. Our data shows that startups with diverse founding teams are 23% more likely to secure pre-seed funding, highlighting the importance of inclusive entrepreneurship.

Funding Trends & Analytics

Deal Volume

Average Round

Time to Close

Pre-Seed Funding by Quarter

Key Insights

-

Sector Dominance: Technology startups account for 74% of pre-seed funding, with fintech leading at 28% of total deals.

-

Geographic Concentration: London, Manchester, and Edinburgh represent 85% of all pre-seed activity.

-

Investor Participation: Angel investors participate in 92% of pre-seed rounds, with micro-VCs in 34%.

-

Follow-on Success: 67% of pre-seed funded startups successfully raise seed funding within 18 months.

Deal Analytics & Market Intelligence

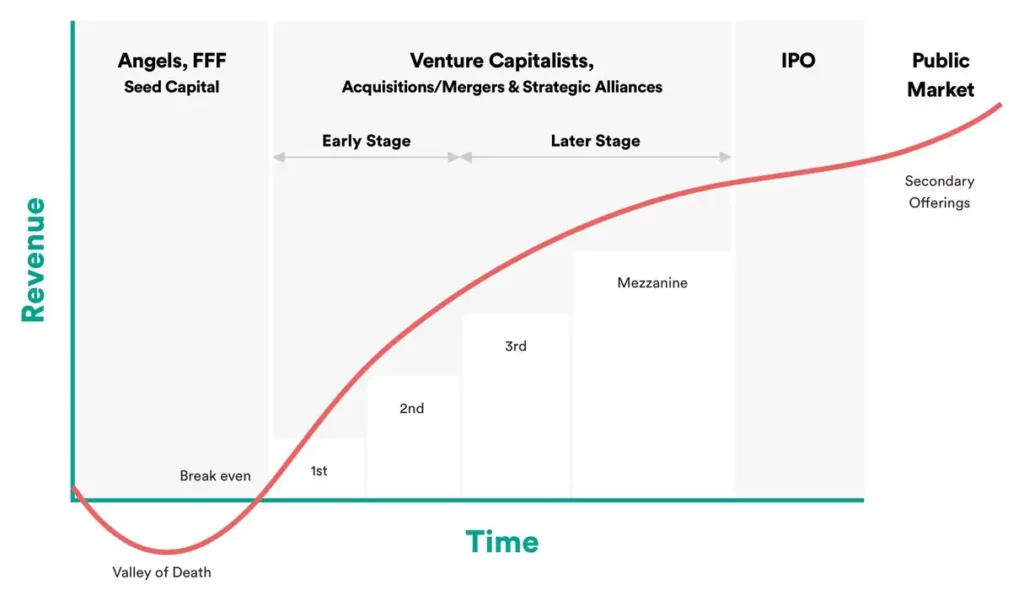

Funding Lifecycle

Understanding the complete funding lifecycle is crucial for startup success. Our analysis shows that startups typically spend 6-12 months in pre-seed stage before moving to seed funding, with most successful companies raising multiple smaller rounds rather than one large pre-seed round.

Regional Distribution

Market Outlook

The UK pre-seed market shows strong fundamentals heading into 2025. Our data indicates continued growth in deal activity, with particular strength in emerging sectors like climate tech and artificial intelligence. The success rate of pre-seed funded startups reaching Series A has improved significantly, from 43% in 2021 to 67% in 2024.

Government initiatives including the Future Fund and increased angel investor activity through SEIS have created a more supportive environment for early-stage companies. This has led to higher valuations and larger round sizes across all sectors.

Regional ecosystems continue to strengthen, with Manchester, Edinburgh, and Cambridge developing robust pre-seed pipelines. The emergence of sector-specific accelerators has also contributed to higher success rates for startups seeking pre-seed funding.

Access Complete Pre-Seed Data

Get detailed insights into UK pre-seed funding trends, deal flow analytics, and comprehensive startup intelligence to make informed investment decisions.